Investor Visa or Golden VISA

Fast and easy. It is the residence permit with the most advantages.

Fast

Streamlining of processing: 10-20 days (positive silence). Agile system for granting visas / authorizations

Free movement in Europe

Allows free movement through Schengen territory for up to three months within a semester

The whole family

Simultaneous processing of family members (spouse or analogous partner, minor children and dependent elderly)

Without permanently residing

For foreigners who own a property, it is not necessary to reside in Spain for 6 months

The residence for investors, also called Golden Visa, grants the residence permit in Spain (and work) to foreigners who make certain investments.

This option is the quickest and easiest way for those who wish to settle in Spain in a short space of time or to be able to circulate in Europe.

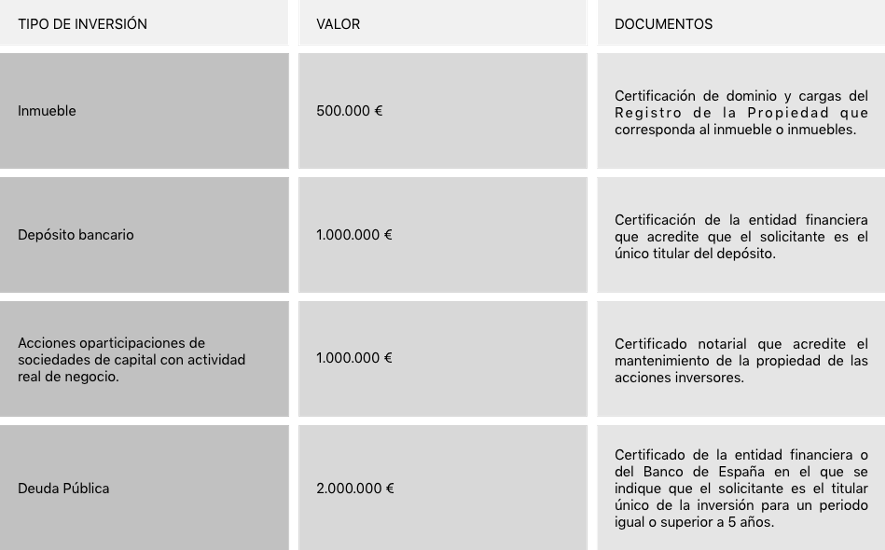

Necessary investment

The usual investment made by our clients is the investment in real estate, so we will make some considerations to this means of obtaining the residence permit for investor.1.- All those properties considered real estate are considered real estate, because they have in common the circumstance of being intimately linked to the ground, inseparably linked, physically or legally, to the land, such as plots, houses, industrial buildings, squares of parking, etc ...2.- The required investment of € 500,000 can be made by acquiring several properties of less value that, adding the cost of all, reach € 500,000.3.- The property or properties must be free of charges for the value of € 500,000. Therefore, if we acquire a property whose purchase price is € 900,000, we can request a mortgage loan for € 400,000.4.- The properties can be leased, so that profitability can be generated for the applicant.In every purchase of a property, the expenses and taxes derived from the sale must be taken into account:-VAT if it is a new home (10% for individuals or 21% if it is done through legal entities, which is deductible) or Property Transfer Tax (from 6 to 10%, depending on the Autonomous Community where the property is located )-Tax on Documented Legal Acts (AJD): 0% - 1.5% depending on the type of property and the autonomous community.- Notary fees, Property Registry: around 1% approximately of the purchase price.

We take care of everything for you

Residence permit, investment, taxes and registration of the property.

Stratego Abogados offers a comprehensive service for interested parties that ranges from searching for the property, offering real estate with guaranteed profitability from the moment of purchase, legal advice for both the sale, settlement of the corresponding taxes, inscriptions in Public Registries. and the application for a residence permit.